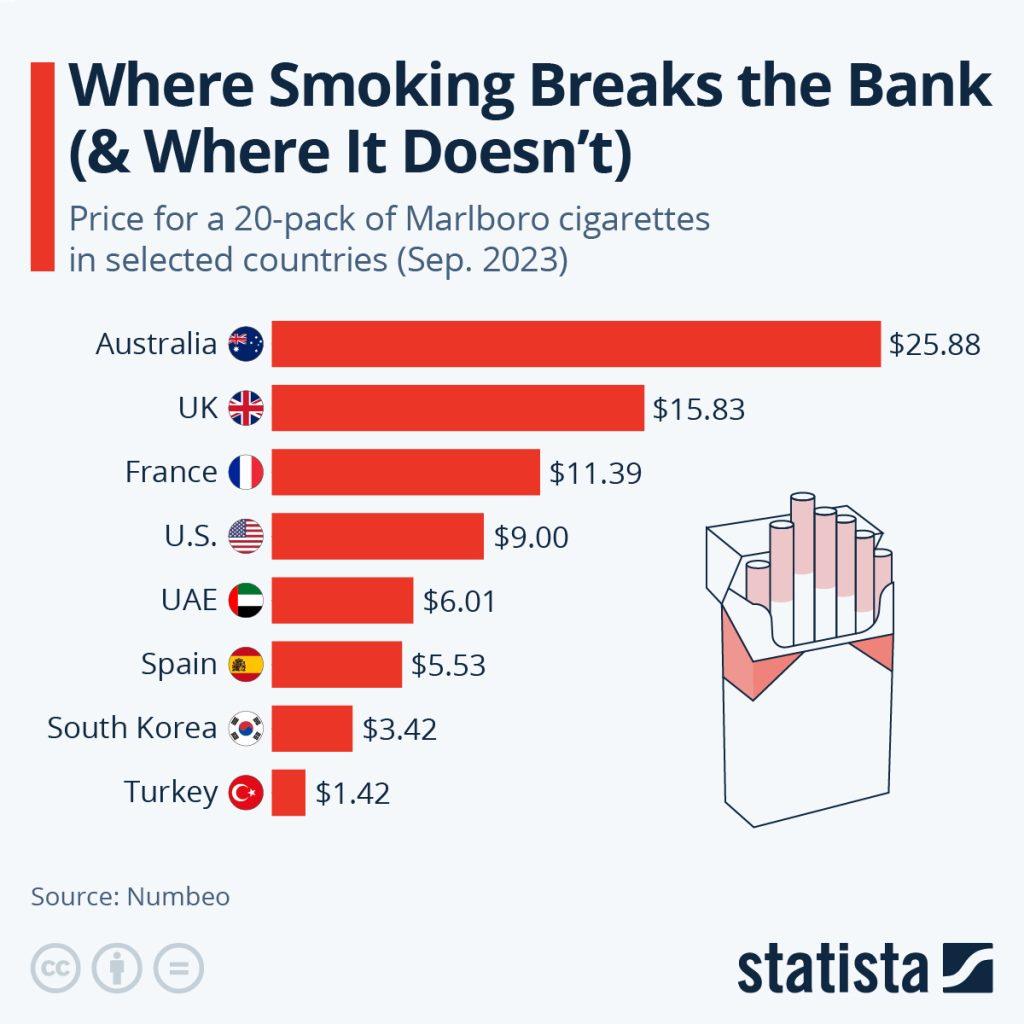

Here’s a structured breakdown of cigarette prices by country and their economic/health implications, categorized by price tiers:

Cigarette Price Categories by Brand & Country

1. Premium Tier ($39–50 per pack)

- Countries: Australia, New Zealand, Norway

- Brands:

- Sobranie (Russia/UK)

- Davidoff (Germany/Switzerland)

- Dunhill (UK)

- Implications:

- Highest taxes (Australia: ~$30/pack in excise taxes)

- Smoking rates dropped by 40% in Australia since 2010

- Black market growth (12% of sales in NZ)

2. Mid-Tier ($25–38 per pack)

- Countries: UK, Canada, France

- Brands:

- Marlboro (USA/EU variants)

- Benson & Hedges (UK)

- American Spirit (USA, organic niche)

- Implications:

- Plain packaging laws (UK, Canada) reduced brand appeal

- Youth smoking decline: UK rates at 8% (vs. 26% in 2000)

3. Budget Tier ($6–15 per pack)

- Countries: USA (NYC/Chicago), Singapore

- Brands:

- Newport (USA menthol leader)

- L&M (Global budget brand)

- Djarum (Indonesian clove cigarettes)

- Implications:

- Regional disparities: $6/pack in Missouri vs. $15 in NYC

- Menthol bans: EU (2020) vs. USA (delayed to 2026)

Key Economic & Health Insights

-

Taxation Impact:

- Australia’s "Tobacco Free 2030" goal relies on annual 12.5% tax hikes

- Philippines ($2/pack) has 23% adult smoking rate vs. Norway’s 8%

-

Black Market:

- Canada: 33% of cigarettes are illicit (vs. 5% in Japan)

- Counterfeit brands: Fake Marlboros dominate in Eastern Europe

-

Brand Adaptation:

- Heat-not-burn (IQOS): PMI shifts focus to $8 TEREA sticks in high-tax markets

- Flavor bans: Menthol survives in Indonesia ($3/pack for Gudang Garam)